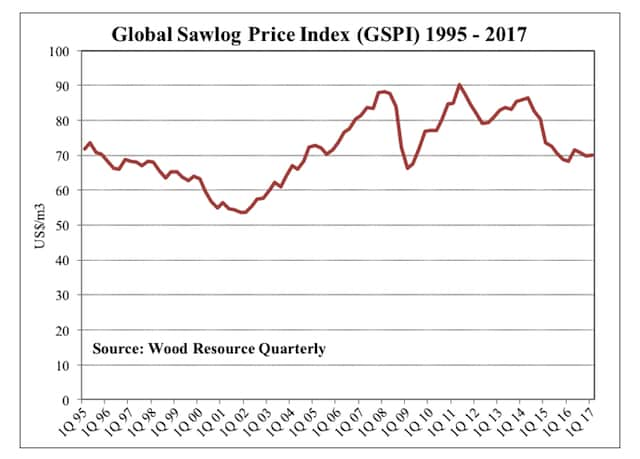

The Global Sawlog Price Index (GSPI) was up 0.3% quarter-over-quarter in the 1Q/17. Over the past year, sawlog prices have generally gone up in Latin America, Oceania and North America, while they have declined in Europe.

In the 1Q/17, the European Sawlog Price Index (ESPI-€) was €83.12/m3, which was practically unchanged from the previous quarter. Since the record high in the 1Q/14, the ESPI-€ has fallen by 8.3% with the biggest declines seen in Central and Northern Europe.

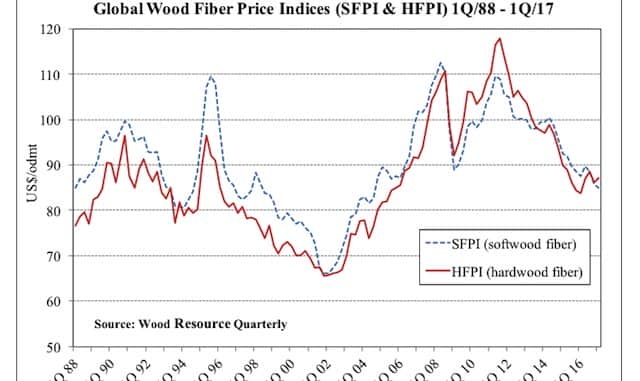

The Global Softwood Fiber Price Index (SFPI) fell 0.7% quarter-over-quarter in the 1Q/17, which was down 3.0% from the 1Q/16. The SPFI has been in decline for almost five years and is currently at its lowest level since the 3Q/04. In real terms, the SFPI in the 1Q/17 was at its lowest level since WRQ initiated the index 30 years ago in 1988. The biggest recent declines in softwood fiber costs for the pulp sector have occurred in Eastern Canada, Finland, France and Germany.

Hardwood wood fiber prices have generally moved up worldwide in the 1Q/17, with the Global Hardwood Fiber Price Index (HFPI) increasing one percent q-o-q to $86.99/odmt in the 1Q/17. Prices rose the most in Australia, Brazil, Russia and the western US.

Demand for chemical market pulp was up by over six percent during the first three months of 2017 as compared to the same quarter in 2016. Chinese demand was up the most, 22%, while Western Europe was the only region where consumption was down in early 2017.

Demand for chemical market pulp was up by over six percent during the first three months of 2017 as compared to the same quarter in 2016. Chinese demand was up the most, 22%, while Western Europe was the only region where consumption was down in early 2017.

Prices for most pulp grades have increased in early 2017 because of a combination of tight supply and continued strong demand.

The BHKP price has gone up the most this year, having increased almost $90/ton to $740/ton in just four months, while the price rise of NBSK has been a more modest $30/ton from January to April.

Globally traded softwood lumber reached an all-time high in 2016. WRI estimates that 118 million m3 of lumber was traded last year, or 10 percent more than in 2015. Imports to the US account for about one-third of globally traded lumber and have almost doubled in five years. China accounted for about 17% of import volumes in 2016.

Lumber production in North America in 2016 was up six percent from the previous year, reaching its highest level since 2007. The biggest rises in production were in the US South and Eastern Canada, while the increases in western Canada and the western US were more modest. This trend continued during the first two months of the year with production on the continent being 1.5% higher than in the same period in 2016.

Domestic lumber prices in both Finland and Sweden continue to be close to their lowest levels in ten years in US dollar terms.

Prices for imported softwood lumber to China have been in a steady upward trend during 2016 and 2017 with the average import price in March 2017 being 13% higher than 18 months earlier.

Wood pellet imports to Asia reached an all-time-high in the 4Q/16 when Japan and South Korea together imported 630,000 tons of pellets. Although import volumes were down slightly in the 1Q/17, they were still 43% higher than in the 1Q/16. Over the past ten years, there has been a clear shift in fiber-sourcing for pellet manufacturers in the US South from logs to residues.