Germany’s woodworking machinery industry is expecting solid sales growth in 2015, with current forecasts running at three percent. This increase would see the industry’s total sales of stationary woodworking machines rise to 2.6 billion euros by the end of the year. While the final sales figures for 2014 are not yet available, the Woodworking Machinery Manufacturers’ Association within the German Engineering Federation (VDMA) is standing by its estimate of a five percent or greater year-on-year increase.

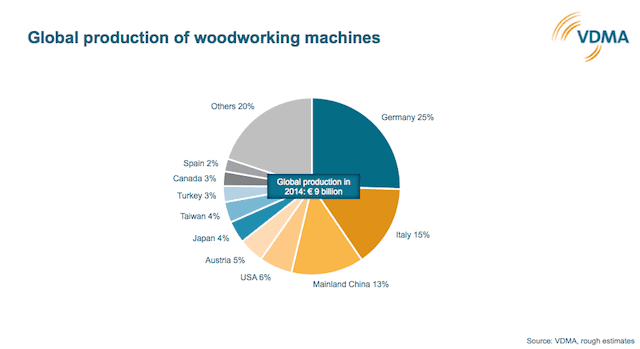

“Despite all the various geopolitical risks, we are confident that sales will grow further this year,” said Dominik Wolfschuetz, the association’s Marketing Manager. The global market situation remains positive overall. The Woodworking Machinery Manufacturers’ Association expects that Asia and North America will more than make up for the expected downturn in Russia. Furthermore, the EU is still on track in its recovery, not least because of Germany’s rock-solid economy and the weakening of the euro against key currencies, such as the US dollar and the Chinese RMB. In other words, because their products have become more price-competitive internationally, Europe-based woodworking machinery manufacturers are in an excellent position to capitalize on the surging worldwide demand for capital goods.

“All in all, everything is shaping up for another successful LIGNA showcase this year. Wood processors and furniture manufacturers from around the world will once again flock to Hannover to see the latest trends and innovations first hand. After all, the opportunity to see the full spectrum of the world’s top solutions under one roof only comes around once every two years,” Mr. Wolfschuetz said.

German exports of woodworking machinery grew 0.8 percent year on year in the first ten months of 2014, reaching a total value of 1.4 billion euros. The 37 percent jump in German exports to Asia, which followed a two-year slump, was partially offset by a weak European market, which saw German exports to EU countries decline by eight percent.

A country-by-country analysis of the figures available to date reveals that China ranks first among Germany’s export markets. Soaring costs and increasing competition within Asia have boosted Chinese demand for highly automated, resource-efficient turnkey plants for the manufacture of furniture and building products. At the same time, China’s already high demand for new panel product plants is showing no signs of abating. Second and third place are held by Russia and the USA respectively.

Germany’s top five export markets account for around 43 percent of its total foreign sales. While three of them enjoyed double-digit growth (China (+19%), USA (+ 18%), Poland (+37%), sales in Russia and France declined significantly, falling by 9 percent and 20 percent respectively. Germany’s fastest-growing export markets include Iran, Vietnam, South Korea, Australia and Belarus, while the biggest downturns were recorded for Italy, Turkey and Brazil.

At 64 percent, Europe’s share of Germany’s woodworking machinery exports was down six percent year on year, while Asia’s share increased five percentage points to 20 percent. North and South America’s combined share remained unchanged at 13 percent.

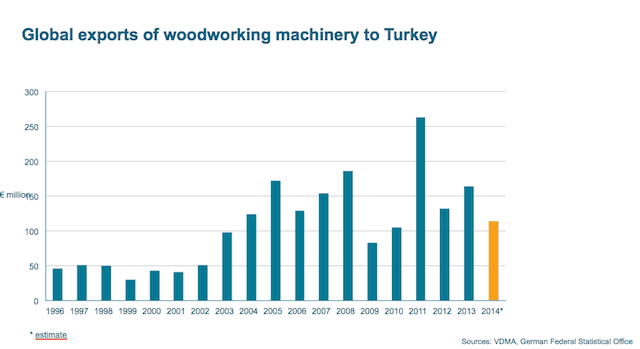

During the first ten months of 2014, German woodworking machinery exports to Turkey totaled 38 million euros – a 42 percent year-on-year decrease, which relegates Turkey to tenth place in Germany’s export market rankings. The strong decline is largely due to a slump in investment spending in Turkey’s panel products industry. However, demand from downstream processors, such as flooring and furniture manufacturers, remains strong. In 2013, Germany was Turkey’s biggest supplier of woodworking machinery, with an over50 percent share of total imports. Second and third place were held by Italy (28%) and Austria (5%).

German exports to Iran, on the other hand, have flourished, thanks to one major investment project and a marked increase in the overall volume of smaller projects. From January to October 2014, Germany supplied around 23 million euros-worth of woodworking machines to Iran, which makes the country Germany’s 16th largest export market. In 2013, China was Iran’s biggest supplier of woodworking machinery, with an over 50 percent share of total imports. Second and third place were held by Turkey (15%) and Italy (10%). The figures for 2014 are likely to show a major turnaround in these rankings, with Germany taking the No. 1 spot by a big margin on the back of an order for a turnkey panel products plant.