Further amplifying the January forecast of the FEP (European Federation of the Parquet Industry) issued at the start of the DOMOTEX fair in Hannover, the consolidated data provided by member companies and affiliated national associations indicates that the market still does not show the signs of the recovery announced and expected by the European authorities. The general picture is, as expected, not uniform with considerable variations from country to country.

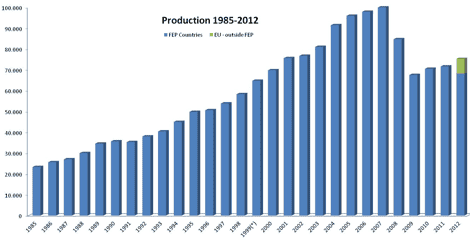

Compared to 2011, the overall consumption figures in 2012 point to a decline of 5.88%. As far as production is concerned, the trend already witnessed in the previous years, namely the strategic choices made by several producing companies to relocate their production in European countries outside the FEP territory, was once again confirmed.

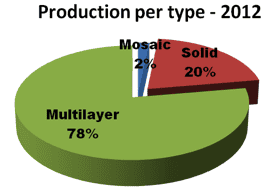

While the total production in FEP territory went down by 4.7% to a volume of 68,266,133 m², the total production in Europe (FEP countries + EU countries outside FEP) is estimated to reach over 75 million m². Increases were recorded in Poland and Belgium, while all other countries were at the best stabilizing. The 2012 total parquet production per type remains similar to the picture already presented in 2010 and 2011, whereby multilayer comes in first with 78% being followed by solid with 20% and mosaic at 2% of the total cake. In absolute production figures by country, Poland is consolidating its top position with 18.97%, Germany still ranks second at 15.24% and Sweden completes the usual podium with 13.3%. The usage of wood species in 2012 points out that oak is advancing further to close to 70%, tropical wood species follow the opposite direction and now show a mere 6.2%. Ash and beech are the two other most common chosen species with 6.5% and 6.1% respectively.

Outlook for 2014

In a continuingly volatile economic situation in the EU, where even the leading financial institutions and the European Commission adapt their forecasts on practically a weekly basis, it is hardly possible to give a waterproof prognosis on developments in the European Parquet Industry in the coming year. The latest market indicators tend to point indeed in the direction of challenging times that still lay ahead. Much will depend on the state of affairs in the construction business, the degree of flexibility of access to housing loans (especially for young people), the evolution on the employment market and related consumer confidence. A prompt structural solution for the economic problems and existing inequalities within the EU-27 guaranteeing a return of long-term political stability is a must. The widening economic & financial gap between Northern & Southern regions of the EU has to be contained, controlled and progressively bridged.

FEP, hence, does not expect that existing and important differences between member countries adhering to our federation will simply vanish in the short term. This would be wishful thinking and unrealistic. Nevertheless, since the start of the crisis in early 2008 the European Parquet Industry has proven to be resilient and able to cope with myriad adversities. It even succeeded to safeguard its market share amongst competing flooring solutions. Real wood quality flooring remains very much in vogue and the never ceasing innovative focuses both in the technical field and design make the growing variety of parquet products always better and increasingly attractive for the end consumer.

Reason enough to confront the challenges with motivation and look into the future with confidence.