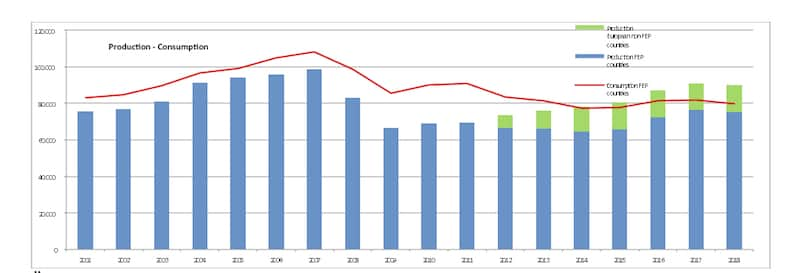

After three years of moderate growth or stabilisation, and despite a generally good start of the year, the overall consumption figures of parquet in Europe downturned for 2018. The consolidated data provided by the FEP – European Federation of the Parquet industry – member companies and affiliated national associations are now pointing to a slight contraction of the global European market by 2,3% in 2018 compared to 2017. It must be noted that, due to the presence of some discrepancies between the official German data, which are collected by the German Federal Statistical Office, and the internal data recently collected by the German federation of parquet (VdP), the production and consumption figures presented below will be revised upward in the coming weeks.

As was witnessed in the past, the results show some variation from country to country. The market contraction is mainly due to decreases of parquet consumption observed in Germany and Switzerland, and, to a lesser extent, in the Nordic Cluster and the Benelux.

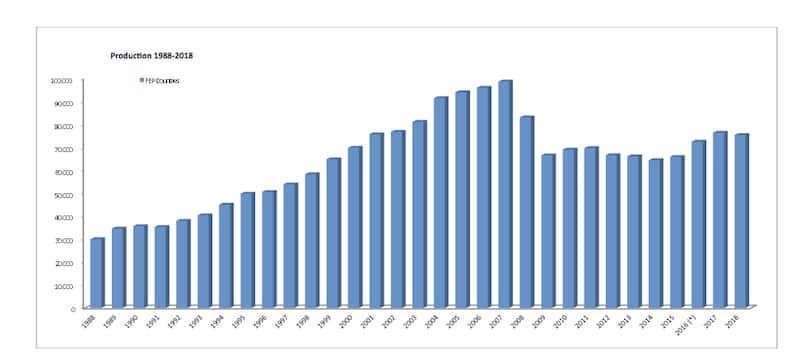

The production in FEP territory declined moderately by 1,3% but exceeds significantly the 75 million square meter threshold. It is important to note that, as of 2007, production and consumption figures for Italy have been revised according to the new method used by the Italian national federation – Federlegno Arredo. The European production outside FEP countries is at an estimated 14,8 million square meters – 9,2 million square meters produced in EU countries and 5,6 million square meters in European non-EU countries.

Parquet production in Europe

(*) As of 2016, figures are covering all European FEP countries – data for Croatia, Estonia, Portugal & Slovenia have been added.

(*) As of 2016, figures are covering all European FEP countries – data for Croatia, Estonia, Portugal & Slovenia have been added.

(**) Best estimates according to information received from FEP affiliates

(***) Italian figures of production and consumption have been revised as of 2007.

The total production in FEP territory slightly declined by 1,3% to a volume of 75.335.600 m². Taking into account the total production in Europe (FEP countries + non-FEP countries in Europe) implies that production in 2018 fell moderately by 0,8% and exceeded 90 million m².

Consumption in the FEP area declined by 2,3%, to a level of 79.854.300 m².

Consumption in the FEP area declined by 2,3%, to a level of 79.854.300 m².

The 2018 total parquet production per type remains similar to the picture already presented from 2010 onwards, whereby multilayer comes in first with 82% (compared to 81% in 2017), being followed by solid (including lamparquet) with a stable 17% and mosaic at 1% of the total cake (compared to 2%).

The 2018 total parquet production per type remains similar to the picture already presented from 2010 onwards, whereby multilayer comes in first with 82% (compared to 81% in 2017), being followed by solid (including lamparquet) with a stable 17% and mosaic at 1% of the total cake (compared to 2%).

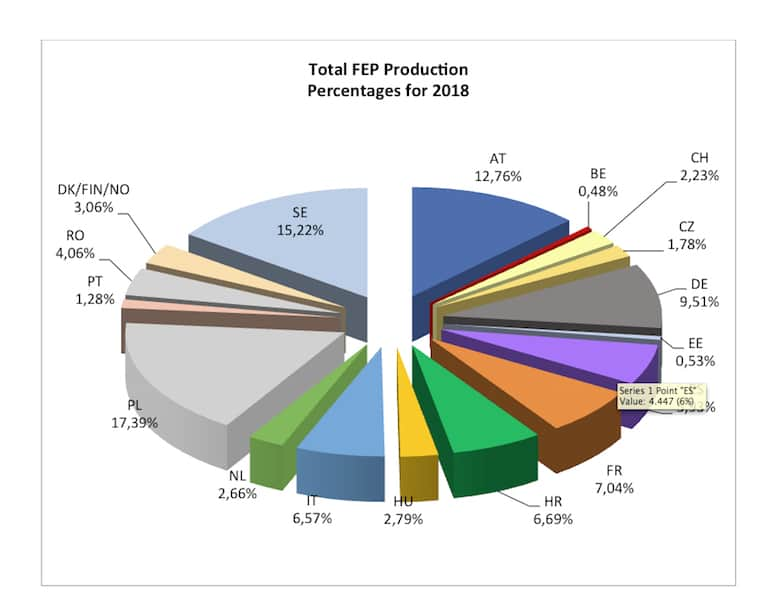

In absolute production figures by country, Poland maintains its top position at 17,37%. Sweden keeps its second place on the podium with 15,22%. It is followed by Austria at 12,76%, while Germany comes in as fourth (9,51%).

In absolute production figures by country, Poland maintains its top position at 17,37%. Sweden keeps its second place on the podium with 15,22%. It is followed by Austria at 12,76%, while Germany comes in as fourth (9,51%).

Consumption in the FEP area declined by 2,3% to reach 79.854.300 m² compared to 81.732.014 m2 the year before.

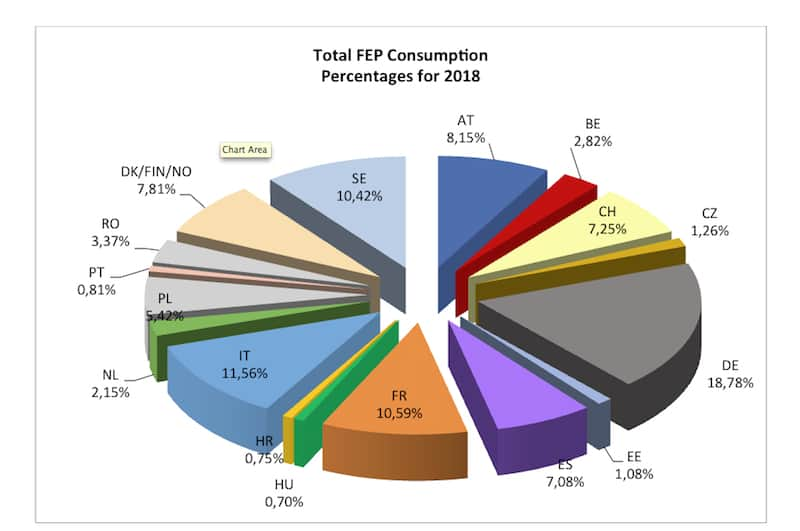

Consumption in the FEP area declined by 2,3% to reach 79.854.300 m² compared to 81.732.014 m2 the year before. In terms of consumption per country, Germany remains in first position, despite its sill declining market, with 18,78% and is followed by Italy at 11,56%. France completes the podium with 10,59%. Sweden at 10,42% gets the fourth seat. Austria with 8,15% keeps its fifth position while the Nordic Cluster (7,81%) and Switzerland (7,25%) come in sixth and seventh position respectively.

In terms of consumption per country, Germany remains in first position, despite its sill declining market, with 18,78% and is followed by Italy at 11,56%. France completes the podium with 10,59%. Sweden at 10,42% gets the fourth seat. Austria with 8,15% keeps its fifth position while the Nordic Cluster (7,81%) and Switzerland (7,25%) come in sixth and seventh position respectively. As regards the per capita parquet consumption, Sweden keeps the first seat (0,81 m2) before Austria (0,74 m²) and Switzerland (0,67 m2). In the total FEP area, the consumption per inhabitant remains stable at 0,19 m² in 2018.

As regards the per capita parquet consumption, Sweden keeps the first seat (0,81 m2) before Austria (0,74 m²) and Switzerland (0,67 m2). In the total FEP area, the consumption per inhabitant remains stable at 0,19 m² in 2018.

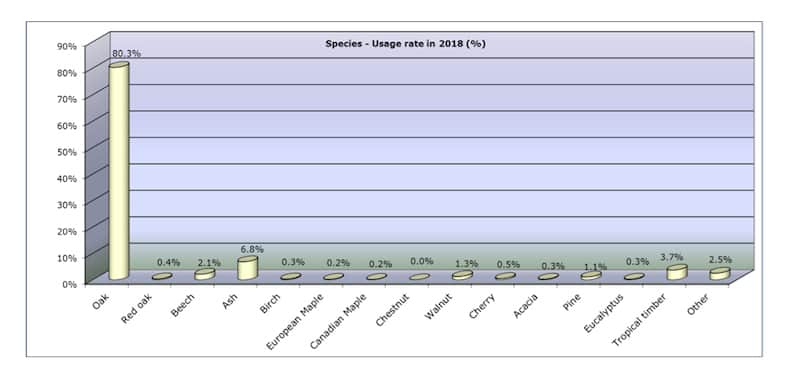

The usage of wood species in 2018 as shown on the above graph indicates that the share of oak remains stable and reaches 80,3% compared to 80,6% in 2017. Tropical wood species use represents 3,7% of used wood. Ash and beech remain the two other most common chosen species with 6,8% and 2,1% (compared to 6,2% and 2,4% in 2017) respectively.

Outlook for 2019 & 2020

After three years of moderate growth or stabilisation, the overall consumption figures of parquet in Europe slightly downturned for 2018. While the market is still lacking visibility for the coming months, the European parquet markets are generally showing stable to slightly positive trends for the three first months of 2019 when compared to the same period in 2018, pointing to stable or moderately increasing parquet consumption. Furthermore, parquet consumption restarted to grow in Germany, the main European parquet market.

On the other hand, the competition from “wood like” flooring solutions, especially from LVT, remains harsh.

As regards raw material, there is no shortage of wood for the time being, but affordability is decreasing also for layers (HDF, plywood) other than the top one.

At European level, FEP welcomes the increasing recognition by the EU authorities of the positive contribution of wood products, including parquet, to fight climate change and to support Circular Economy, Circular Bioeconomy & sustainability. This recognition should be now translated into supportive policies for our industry and used to convince the end-consumer: Parquet is and remains the only Real Wood flooring which allows bringing nature in home and building a better future!